Rise of the Robots

By Lynn Hutchinson, Head of ETF and Index Solutions, Charles Stanley Wealth Managers

Staff shortages, cost efficiencies – and ‘no-touch!’ operations following the Covid-19 pandemic are driving the rise of the robots.

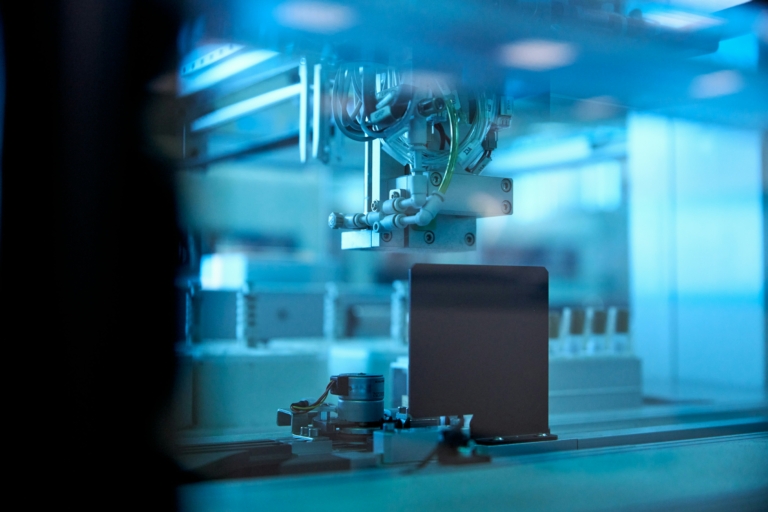

The world of robotics and automation has, for many of us, far exceeded what humans previously imagined possible. Just as the internet transformed how we work and communicate, robotics and automation is changing the fundamental structure of sectors across the economy. Drones are being used to survey the health of crops, surgical robots are conducting more than one million medical procedures each year, and autonomous vehicles are making deliveries. The speed of such technological advances has been made possible due to the convergence of declining technology costs, increasing reliable performance capabilities, and the availability of massive amounts of data fuelling machine learning and intelligence.

The Covid-19 pandemic highlighted a variety of challenges to many businesses. However, those companies that were already using technology and automation were able to capitalise on more effective processes for customer engagement. Robotics and automation, along with digitalisation, were some of the themes accelerated by the pandemic that has subsequently increased the use of technology, with machines that cannot get sick carrying out certain processes.

Re-shoring, labour constraints, and inflation are to some degree driving up spending in automation of every kind. The shift appears to be strong – and accelerating – with the question being not if automation will drive the future, but when.

Technology spending is cyclical but the push for automation spending, especially enabled by robotics, is different in that the need is not cyclical, but consistent. Leaders in nearly every industry are scrambling to automate whatever processes they can and companies that have a consistent need to lower costs and to improve margins may address both with automation.

This increases the importance of automation spending. Automation has become a ‘must-have’ and permanent margin enabler across manufacturing, warehousing, distribution, healthcare, agriculture, and high-touch service businesses, to name a few. Almost three years after Covid-19 hit, companies around the world still complain that they cannot get the work talent they need – and robotics is one way of alleviating this shortage. Increased labour efficiency from advancements in robots and similar automation technology has acted as a deflationary force for the likes of manufacturers by presenting opportunities to lower marginal costs.

In previous years, countries such as the US could import deflation through trade with low-cost producers, especially China. The effectiveness of such tactics is deteriorating as production costs in China are increasing – not to mention the political challenges between these two powerhouses. On top of that, there are border tariffs as well as higher shipping and logistics costs. Demographics and a shrinking workforce are also fuelling inflation. The need for robotics and automation has never been greater. Today, we live through the continuing digital revolution, with robotics raising business productivity and even beginning to help with managing the home.

Diversification is key

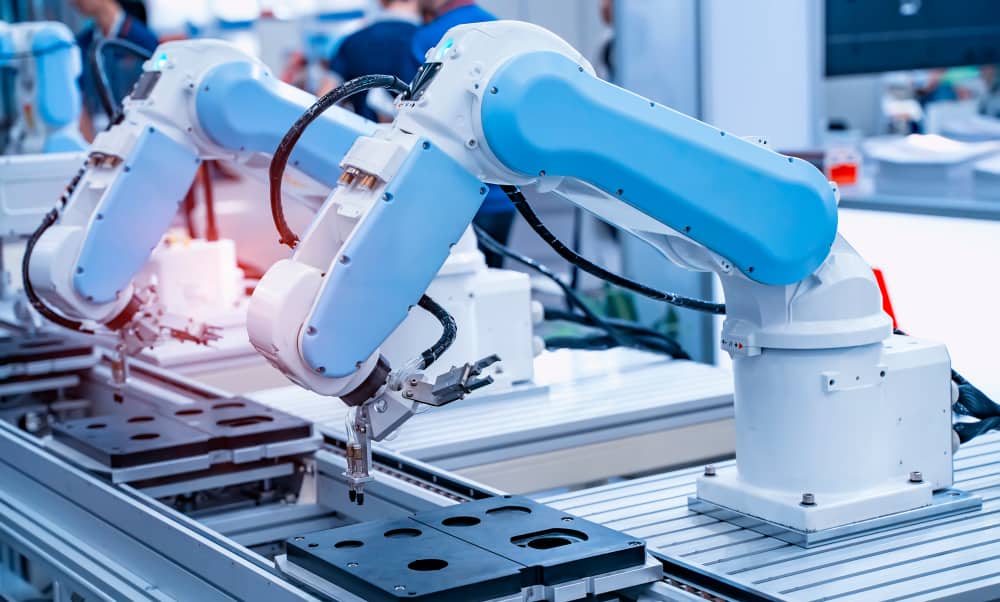

Investors looking at the robotics and automation theme are best served by portfolios that are diversified across geographies, across business models from products to services to software, and across end markets from enterprise to consumer, technology, healthcare, and industrials. Demand for industrial automation today is at record highs and there is more demand for robots and automation than providers can supply.

In Asia, Japanese companies have a combined 40% share of the world’s industrial robot market. In Europe, there is an Exchange Traded Fund (ETF) tracking this theme – the Robo Global Robotics and Automation UCITS ETF launched in 2013. It tracks the ROBO Global index, which combines fundamental research with insights from world-leading industry experts. The ROBO Global index committee reviews suitable companies to be included in the index based on ongoing research, engagement with company management teams, and market developments. The index equal weights around 80 individual companies based on revenue purity in the theme and market/technology leadership of the underlying companies included in the ETF. Top country exposures are the US, with a 46% weighting, followed by Japan with a 22% weight. Industrial sector companies account for just over 40% of the overall ETF.

If you would like to discuss any of the themes in this article, or to find out how Charles Stanley can manage an investment portfolio on your behalf, please contact a member of the Oxford team.

If you would like to discuss any of the themes in this article, or to find out how Charles Stanley can manage an investment portfolio on your behalf, please contact a member of the Oxford team.

01865 987 485

The value of investments, and any income derived from them, can fall as well as rise. Investors may get back less than originally invested. Charles Stanley is not a tax adviser. Information contained in this article is based on our understanding of current HMRC legislation. Tax reliefs are those currently applying and the levels and bases of taxation can change. Tax treatment depends on the individual circumstances of each person or entity and may be subject to change in the future. If you are in any doubt, you should seek professional tax advice. Charles Stanley & Co. Limited is authorised and regulated by the Financial Conduct Authority.