The risks of jointly owning a business

When can having a business partner, or multiple shareholders in a business, give rise to problems, writes Lee Thomas of Pangea Life?

And when can those problems be so expensive that they can jeopardise the very survival of your business?

Having business partners can bring a lot of security and advantages to a business. You have people to share the tough decisions with, you are pooling a diverse range of skills, knowledge and experience and when you started the business you possibly shared the financial burden of those early days whilst establishing yourself.

However, jointly owning a business can also bring a number of added risks and challenges, particularly when it comes to a shareholder leaving the business.

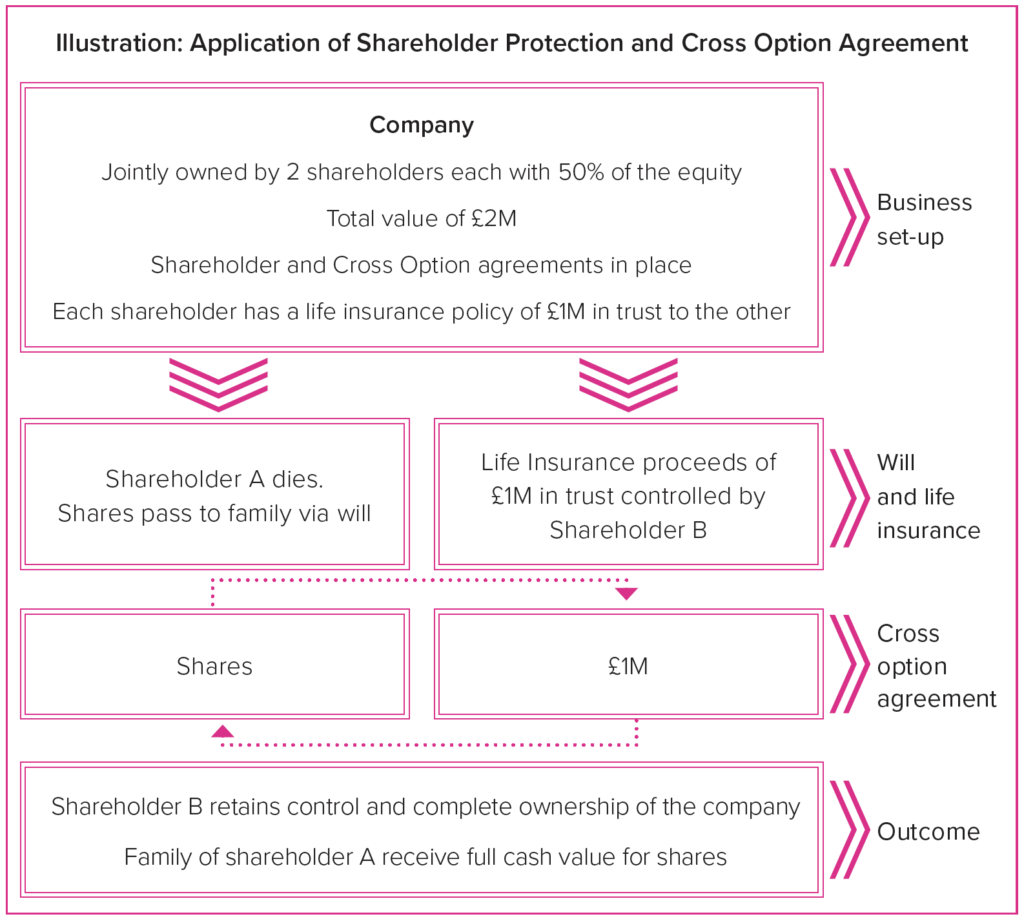

This is why having a shareholder agreement and cross option insurance is so important.

Amanda Brockwell, a Partner in the corporate team at Paris Smith LLP explains:

Business owners can protect themselves against risks arising whenever ownership of the company is shared. A shareholders agreement will cover the rules around ownership and transfer of shares in the company. It can set out a procedure and valuation mechanism for any shareholder who wishes to sell shares, and leave the company, and manage more easily a sudden and unplanned departure of a key shareholder.

Generally, in that situation finding the money to buy out a departing shareholder is often one of the more difficult things shareholders have to face. The remaining shareholders of the company will always want to prevent outside third parties becoming co-shareholders, and generally want at least the rights of first refusal to acquire any outgoing shareholder’s equity.

The death of a shareholder

Occasionally, an unplanned departure could include a situation where a shareholder dies. With no shareholders agreement, the shares are free to be passed to anyone under that deceased shareholder’s will or rules of intestacy – so surviving shareholders may find that they have a donkey sanctuary as a co-shareholder, depending on the contents of a will. Remember, a will is a secret document and the contents of a will only be known for sure once a shareholder has died. If your shareholders agreement prescribes what should happen to the shares, that shareholders agreement will prevail over any will or the rules of intestacy. It is for this reason that often ‘cross options’ are included. The deceased shareholder grants surviving shareholders the option to acquire shares after his/her death. The other shareholders will grant the deceased’s estate the option

to require the first option to be exercised. This creates something which is akin to a contractual right for surviving shareholders to buy out the shares in the company which on death are automatically held by the deceased’s estate. For inheritance tax purposes, however, this is treated purely as an optional arrangement and therefore Business Property Relief, an important tax relief to save inheritance tax, will still apply.

Insuring the life of all shareholders means that:

- funds can be made available to meet the purchase price in this situation

- surviving shareholders do not have to find the cash on short notice to buy out shares;

- the company does not find itself with unknown family members as shareholders

- all shareholders will also have the comfort of knowing that in the event of their death, their estate/family will receive the benefit in cash of the value of their shares.”

Incapacity of a shareholder

Where shareholders, in practice, all work in the business, if one shareholder becomes ill for a protracted period of time and unable to work, a similar mechanism, including insurance cover, can be put in place. This means that in the event of prolonged absence, difficult conversations around whether an unwell shareholder should remain as a business owner, are avoided – the shareholders agreement will provide for this – and policy proceeds paid out by an insurer will be readily available to acquire shares.

For more information:

[email protected] or 01962 677808 www.parissmith.co.uk

Lee continues: as Amanda outlines, not only is it important to have the right agreements in place to ensure surviving shareholders of a business have the appropriate rights to maintain control of the company when an equity partner dies or becomes incapacitated, but having the right insurance in place enables the transaction to take place without incurring the financial burden of the purchase.

When it goes wrong

A client came to me a couple of years ago having already gone through the painful loss of one of his business partners. The deceased shareholder at the time of his death owned 45% of the company. They had the right agreements in place which enabled the other two shareholders to purchase the shares, but they didn’t have any insurance in place. Based on the valuation of the business at the time of death the two surviving owners needed to raise £600,000 to buy the equity.

With the loss of such an important person to the business they were already plunged into a period of instability and financial insecurity. Raising funds personally or through the business was not an option. Their only choice was to come to an agreement with the deceased shareholder’s family to buy the shares over a period of time, effectively wiping out company profits for several years.

A shareholder protection insurance policy on each of the shareholders would have saved them this problem and a lot of money. The insurance would have cost this particular client approximately £1,500 per year – a multiple of 400 times less than the eventual cost to them.

As the saying goes: “hope for the best, prepare for the worst”. Business partnerships, by their very nature, start out as endeavours of enthusiasm and co-operation. But like any partnership things can go wrong and when they do, they create a whole set of problems that can become difficult to navigate. The breaking up of a partnership is a common problem and is particularly difficult, in so many ways, if due to the unexpected death or incapacitation of a business partner. Shareholder and cross-option agreements provide a structure for working through these issues and with the right insurances in place, the financial implications for solving them, do not add an extra dimension to the challenges you’ll face.

For more information:

enquiries@ pangealife.co.uk or 02382 354 354 www.pangealife.co.uk