The benefits and risks of Management Buy Outs

Over the past few years Pangea Life has been particularly active in helping businesses, as well as the professional advisors supporting them, to mitigate the potential financial risks that can be created when going through a Management Buy Out (MBO), writes Lee Thomas of Pangea Life.

Here he asks Phil Mettam from Meridian Corporate Finance to give his views on some of the benefits of MBOS, as well as a few of the risks to look out for:

The last few years have resulted in a fairly turbulent economic and political environment – challenging businesses and their resilience. This has inevitably impacted the M&A market – both as buyers take stock and reconsider their acquisition strategies, and as investors restrict their appetite in certain sectors and take a more diligent approach to investments.

Increasing challenges

Whilst transactions involving third party buyers are becoming increasingly challenging to deliver, MBOs continue to provide vendors with a low-risk route to realise value and obtain certainty. MBOs are structures through which the existing business is purchased by the existing and/or new management team. At Meridian, we have facilitated several exits or succession plans through an MBO in the last 12 months, as the desire to exit remains (and in some cases is exacerbated). However, buyers and investor appetite is dampened and their processes are typically longer and more challenging.

There are several nuances and the best structures are those that consider and look to address business risks and ensure longer-term business continuity, as part of the structuring process. Overall, MBOs can address a number of issues on day one including succession planning and management continuity through equity ownership. MBOs can also provide the business with the toolset to address longer-term goals such as onboarding external talent and correcting shareholding structures to reduce business risks and achieve a future third-party sale.

Greater risk

MBOs incorporate a relatively modest level of external leverage (if any) and as such, the vendors naturally take a greater risk compared to a traditional third-party sale. The vendors also have greater risk, as they are reliant on the new management team to continue operating the business to repay their deferred consideration. Whilst equity incentives are extremely strong, and the legals look to cover off a vast majority of scenarios – circumstances may be unforeseen.

Overall, circumstances vary from transaction to transaction; careful planning, prudent forecasting and careful legal documentation is key to ensure that the risks and rewards are appropriately balanced between management team and vendors.

For more information: [email protected] or 023 8026 8793 www.meridiancf.com

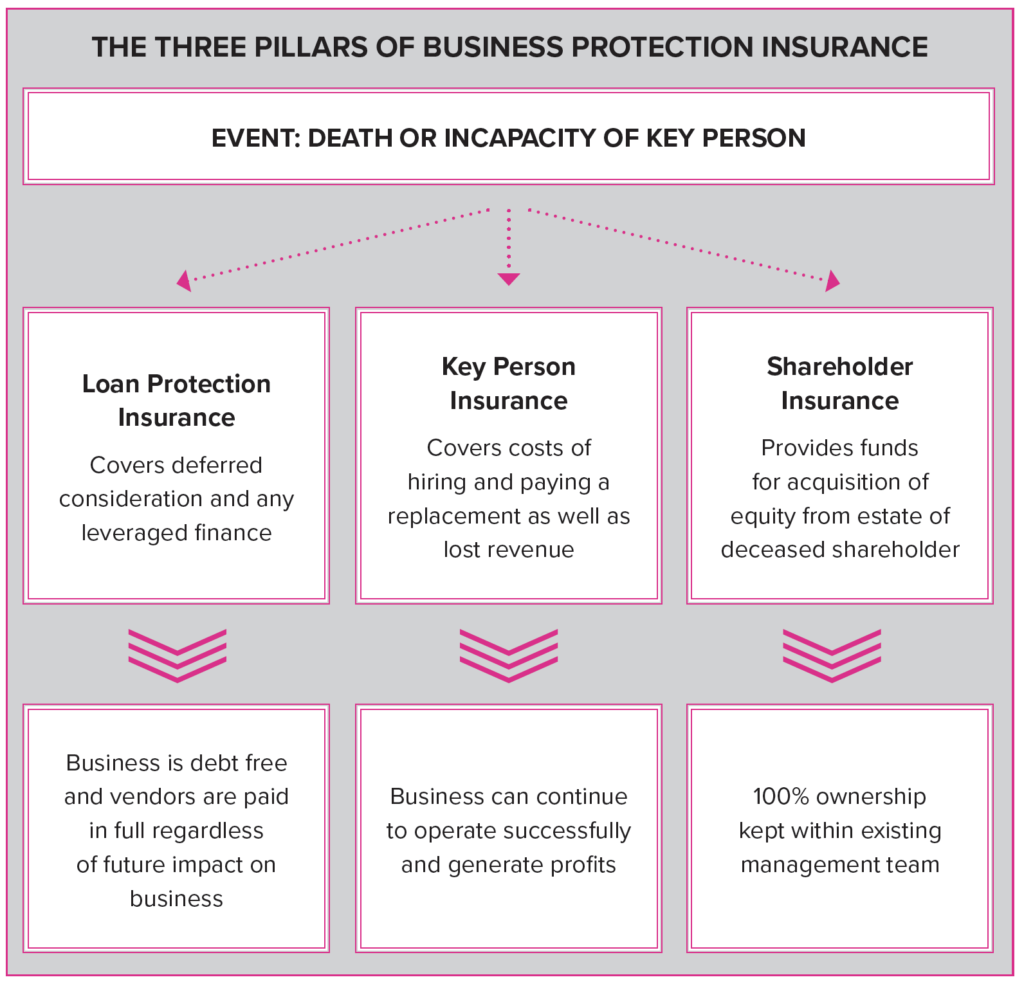

As Philip highlights, one significant risk for someone selling their business through a MBO is that the new management team keep the business operating and profitable so that the deferred consideration is repaid.

Key person risk

Deferred consideration: The first is that the insurance can provide a lump sum for the business to completely clear any outstanding deferred consideration, as well as any external finance owed. Not only does this allow the vendors to get their money, regardless of any jeopardy the company might be plunged into, it also leaves the business debt free, giving the new owners a better chance of rebuilding.

Profit: The second is that the insurance can provide a further injection of cash into the business to keep the business operational and profitable. This could be a combination of paying for the recruitment and salary costs of new personnel as well as replacing any lost revenue if the key person played a significant role in generating income for the business.

Ownership

A further risk that can be covered is the one I discussed in my article in the previous issue – Shareholder Protection. If one of the equity partners dies, it can leave the surviving owners with the problem of needing to raise capital to buy the deceased’s shares from their estate. Shareholder Protection will provide the funds needed to do this, ensuring no new debt is placed on the business.

De-risking M&A deals

Another type of insurance that can be used to de-risk M&A deals is Warranty and Indemnity Insurance. This protects buyers or sellers of a company against breaches in representations and warranties. Insurers offer policies that are either ‘buyer-side’ or ‘seller-side’. It provides a number of advantages including:

- Removing the concern of not being able to collect on a seller’s promised indemnification.

- Hastening a business sale by eliminating the need for escrows and by covering the liabilities of future representations and warranties claims.

- Allowing a seller to fully and completely leave a business, if desired.

- Making it easier for the buyer to maintain a good relationship with the seller, who may become the buyer’s employee or business partner after the transaction.

As well as using insurance to de-risk a deal, an appraisal of a company’s insurances is also a valuable exercise when buying a business. This should include reviewing the adequacy of both historic and current insurances as well as identifying future risks to the balance sheet and recommended solutions.

Selling your business isn’t without risk. If it’s an MBO with a significant amount of deferred consideration and the business is of a size where a few of its people are vital to its success, the risks are even greater. The right insurances can give both the vender and buyer an added level of protection and with it peace of mind.

For more information:

enquiries@ pangealife.co.uk or 02382 354 354 www.pangealife.co.uk