HSBC's Mark Berrisford-Smith gives economic outlook and says inflation 'past its peak'

Things are looking up for businesses, but don’t expect too much too soon, said Mark Berrisford-Smith, HSBC UK’s Head of Economics, speaking at The Business Magazine’s 2023 Business & Economic Outlook, sponsored by Begbies Traynor

“Commodity prices have been falling back since last Spring, especially food and energy prices, which all surged after Russia’s invasion of Ukraine,” said Mark. “They are now where they were before the invasion and while they’re still high by historic standards – they’re not as high as they were.”

Mark was giving a keynote speech alongside fellow panellists, Julie Palmer, Regional Managing Partner at corporate recovery and professional services firm Begbies Traynor, Professor Bernd Vogel, Founding Director of Henley Centre for Leadership and Henley Centre for Leadership Africa at Henley Business School and insolvency expert at law firm Blake Morgan, Katie James.

Mark also pointed to the results from business surveys across the world. “These can be confusing to interpret, but it’s fairly clear that businesses around the world are feeling better, and the recessions we’d all feared are now much less likely to happen.”

Inflation past its peak

Inflation is past its peak, and while the world at large has done a pretty good job of adapting to the reality of the war in Ukraine, there isn’t room for complacency.

In the UK, with all the political shenanigans during the summer and autumn of last year, the bottom line is that this country hasn’t seen any growth in the economy for a year, the jobs market is tight, supply issues remain in some sectors, and the economy is still smaller than it was pre-pandemic.

“Between 600,000-650,000 businesses are showing significant signs of distress – that’s almost 15 per cent of UK business"

JULIE PALMER

“These are holding the UK back and will take time to sort out,” added Mark.

Living standards are also falling thanks to inflation running well ahead of wages growth, the upshot of which is that many people feel under pressure to change their spending behaviour.

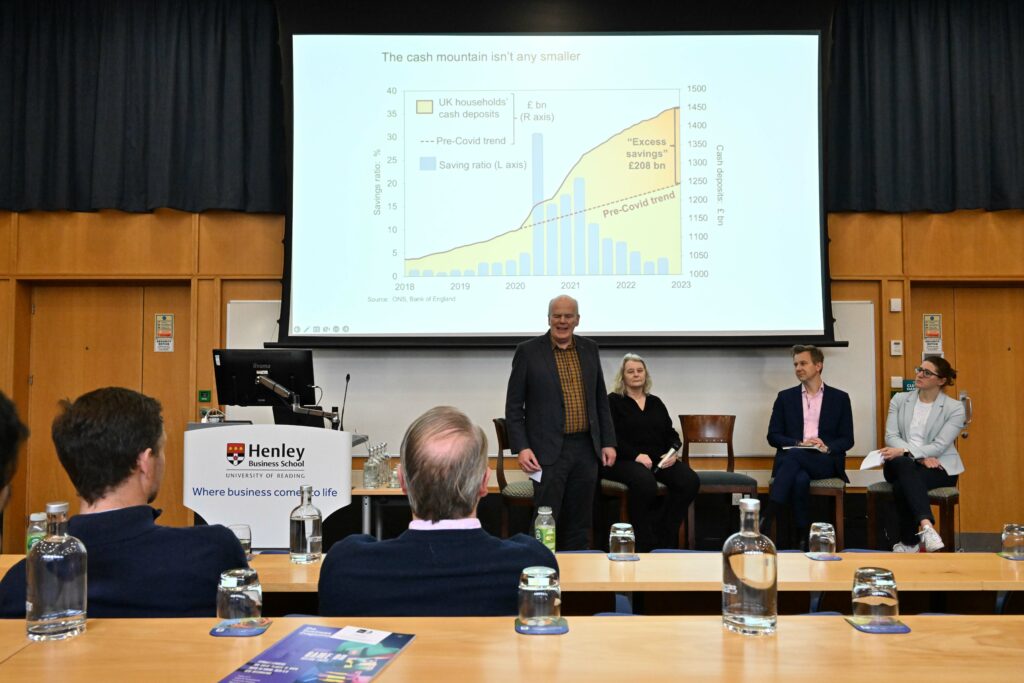

“But we do have something this time around which we didn’t have before and that’s the mountain of cash we are all sitting on,” said Mark “Before the downturns of 1990 and 2008, people had ‘binged on debt’. But during the pandemic, many of us were at home, by and large being paid, with nowhere to spend it. As a result, cash has been building up in the banks for the past three years.”

Of course, this situation isn’t across the board, he pointed out, and many people are facing a cost-of-living crisis – but not all.

The Spring budget focussed on improving the UK’s poor productivity. “The Chancellor wants to get firms to invest and to increase workforce participation,” said Mark.

But with little financial wriggle room, there were things Jeremy Hunt wanted to do that he couldn’t.

Mark said: “He wants to extend the full expensing of capital expenditure beyond three years, he wants to increase the defence budget and continue not putting up the duty on fuel. He would like to have a penny off the income tax before the next election. None of that will be possible unless he gets more favourable winds from the forecasts provided by the Office for Budget Responsibility – or makes some hard choices about spending.”

Job vacancies have fallen, but not fast enough. The UK has still got more than 1.1 million vacancies. Pre-pandemic, that would have been around 800,000, said Mark. “Until we get somewhere in that ballpark, upward pressure on wages will continue and at the rate we are going, it’s going to take a few years, so core inflation, stripping out the cost of food and energy, could continue to be quite sticky.”

Julie Palmer at Begbies Traynor agreed. “Six to nine months ago, supply chain issues were prevalent. The high cost of materials meant businesses were having difficulty in pricing contracts because they didn’t know where costs were going. The businesses which got that wrong are the ones which have come to us for help.”

While that issue has settled down somewhat, common themes continue to be energy prices, wage inflation and skills shortages.

Are you tired from running your business?

And another problem is now evident: director fatigue.

“Small business owners have come to us saying it’s just wave after wave of bad news and increasing regulation,” said Julie “Between 600,000-650,000 businesses are showing significant signs of distress – that’s almost 15 per cent of UK business.

“The real gamechanger has been that the banks have been supportive to business and kept them alive where possible. The prolonged period of low interest rates has also helped business service their debts and the pandemic meant that creditors couldn’t take action through the courts.”

For those businesses which are struggling now, the earlier they take advice the better, she advised.

Professor Bernd Vogel said that some directors he saw still felt optimistic, but drained – and that wasn’t just at director level. “Business owners and directors have had enough economic zig-zagging, they just want calm – even boring.

“But is that the narrative you want around your business? While it might offer a holding pattern, it’s not good enough when you’re looking to grow.

“No-one wants to say to investors ‘I’m a boring business, invest in me’. A business needs to decide when it’s ready to motivate and mobilise. It will need to decide when it is ready to come out of survival mode and turn the corner. It’s up to the directors to decide on their own narrative.”

Insolvency expert at law firm Blake Morgan, Katie James, agreed that it’s tough for businesses, struggling at the lower end of the market.

Many have significant debt which saw them through the pandemic but is costing them a lot more because of the last Autumn budget, particularly in the retail, hospitality, care and construction sectors.

“In order for them to sustain those levels of debt they need to grow,” she said.

There is a harsh economic fact that to re-energise markets, some of the poor performing businesses need to go, which will create opportunities for those which have come through pandemic with cash and want an opportunity to use it.

Survival of the fittest will help the UK economy

Julie agreed. “There is a phrase for such businesses which are not going anywhere and hanging on for grim death: zombie companies.

“Business failure is usually regarded as a bad thing but keeping zombie businesses alive isn’t good. The Darwinian view is that the poorer businesses will fade away and the better capitalised businesses will pick up that market share and use their working capital more effectively which helps recovery. While we have to be mindful that with every business failure there is redundancy, with the tight labour market, it is likely to be easier to find a job than previously.

“If you can recycle human capital into a more vibrant sector of the economy, it will help.”

Kate added: “HMRC is starting to take a more aggressive approach. There are more winding up petitions and less time to pay arrangements which perhaps we didn’t see last year. That will force Zombie businesses into action. We urge directors to begin examining where the risks lie within their business and how they can be mitigated with a business continuity plan. We also urge them to ask key questions such as: Do I want to stop working? Are there any senior managers within the business who want to step up? Could we undertake an MBO or is the business in good enough shape to sell to a competitor?”

Does hybrid working damage productivity?

Much of the following question and answer session picked up on business productivity and hybrid working. Was it working? What does that mean for commercial real estate and the smaller service businesses such as convenience stores and cafes which rely on commuter trade?

Professor Vogel said that learning how to make work from home or hybrid working effective is key. “The assumption by some businesses that productivity drops when staff work from home more isn’t necessarily the case. Someone who isn’t working at home may not have worked at work for years, and it’s been overlooked.

“There is also the issue of wellbeing. Are your staff supported properly both in the office and at home?”

Katie added: “I work with bright, intelligent young people and they are clear about what they want and don’t want, and flexibility is key for them. It’s important that we offer our staff the chance to work where they need to work, to get the job done. The client’s needs must come first. That could be at our client’s office, in any one of our offices or from their home. It’s different for individuals and businesses. I agree it’s about testing assumptions and good communication is key.”

Julie agreed: “Many of us run businesses where we can map and monitor productivity. I’m pretty open minded in terms of flexible working because it’s been a game-changer for me. I have a number of staff working remotely and we have seen no drop in productivity.”

For service providers with trainees who learn faster in the collaborative environment of an office, they do need to come to work – at least for the majority of the time, said an audience member.

Does working from home damage the UK’s productivity as a whole? According to Mark Berrisford-Smith, it doesn’t so far appear to have made a material difference.

“What seems to be happening is that there is only a very gradual return to offices, so that it’s unlikely to get back to more than 80 per cent of where it was before. This is especially a London and south east phenomenon where there are commuter trains rattling around half empty. If you look at the footfall in cities outside London, such as Birmingham, Manchester, Leeds, Liverpool or Newcastle, they are closer to what they were pre-pandemic than in the capital.

It's been a torrid three years for businesses, but a brighter future is all about looking at the positive, said Professor Vogel.

“Always focussing on how bad things are really won’t help. There’s always something every business can learn from others. That’s more likely to get us through.”