HSBC launches £15BN lending for small and medium-sized businesses

HSBC UK has launched its 2022 £15 billion lending Fund for small and medium sized businesses today, supporting local economies, employment opportunities and driving growth across the country.

Whilst concerns about the broader market remain, HSBC says its customers are thinking about growth via investment, acquisitions and capital expenditure.

The fund is a key part of HSBC’s commitment to help British businesses to innovate and thrive in the UK and internationally. SMEs are vital to the UK economy and account for three-fifths of the employment and around half of turnover in the UK private sector according to the FSB. The fund includes specific regional and locally focussed allocations so that companies throughout the country can benefit.

This year’s fund also includes allocated funding for businesses trading internationally (£2 billion), in the agriculture sector (£1.2 billion) the tech sector (£500m) and franchise businesses (£500m).

It is complimented by the Green SME Fund (£500m) for businesses of all sizes to transition and thrive in a low carbon economy and the new Growth Lending (£250m) for high growth tech businesses to support well-equitised, high growth, loss-making scale ups early in their growth journey.

Since launching its annual SME Fund in 2014, HSBC UK has lent more than £90 billion helping businesses to make the most of their money, now and into the future and opening up a world of opportunity for our customers.

Peter McIntyre, Head of Business Banking at HSBC UK, said: “SMEs are vital to the UK economy, and our customers have told us they are ready to invest for growth. The £15 billion Fund will help businesses to expand internationally, as well as here in the UK, supporting key sectors and driving investment across the regions.

“We want to make a significant contribution to economies across the country, driving employment, local wealth and growth by providing funding, when and where it’s needed most. We know our customers are innovating and adapting at pace and British businesses need their bank to be flexible, supporting future growth opportunities.”

Small Business Minister, Paul Scully said: “This new Fund puts HSBC on course to have lent more than £100 billion to UK small businesses within a decade, which is a great milestone for HSBC and even better for the communities across the country being helped to thrive.

“This extra funding builds on the support available through government schemes like Help to Grow and Start Up Loans to help small businesses grow and reach their full potential.”

Small Business Commissioner, Liz Barclay, said: “The challenges facing small businesses are beyond imagination. The problems caused by poor payment practices such as late or delayed payments, and extended payment terms pile pressure on cash flow. Small firms are the lifeblood of the economy, and they must be paid fast and fair, and if they are to have the confidence to invest and build the resilience, they’ll need to weather the storms ahead and they will need the support of Funds like this more than ever”.

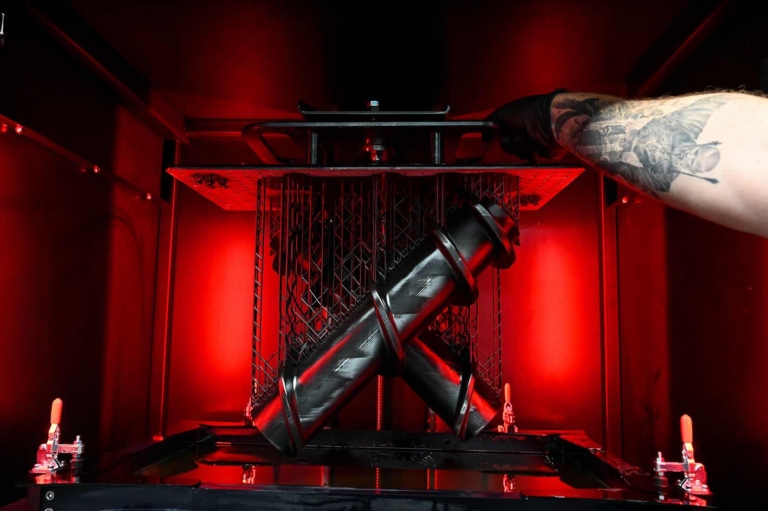

Weston-super-Mare Eco Charger, the world’s first all-electric quad bike business used the 2021 Fund to increase production and invest in its supply chain due to increasing global demand for its high quality, eco-friendly quad bikes.

The Eco Charger business was born back in 2011, when founder Fred Chugg recognised a gap in the market for electric powered all-terrain vehicles (ATVs). Since then, the business has been able to expand overseas to America and Australia. Built to high specifications and to meet green credentials, Eco Charger’s cutting edge vehicles operate in numerous global sectors, including eco-tourism, farming, policing and public services.